Downsizing For Retirement: A Step-by-Step Guide

Millions of older Americans are choosing to go small in retirement.

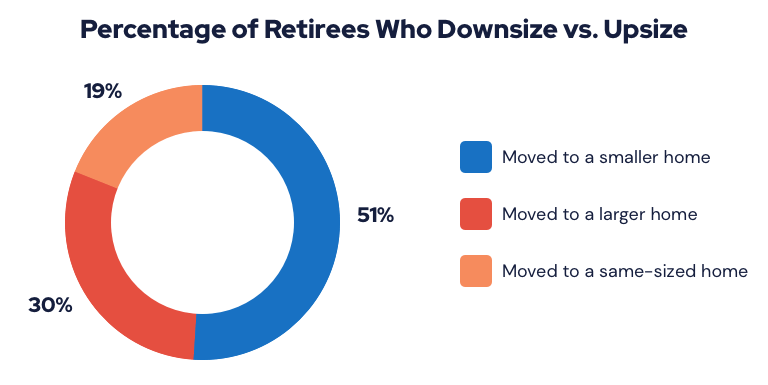

According to a Zillow report, 46 percent of baby boomers who sold homes in 2017 were in the process of downsizing.

Downsizing is a major decision, influenced by unique financial and emotional factors.

Decluttering a large home is no easy feat. Selling your house, finding a new one and moving your belongings adds further complexity.

In this guide, we explore the reasons people downsize for retirement and share advice from experts on how to navigate the transition.

We also look at other aspects of the process, such as getting your home market-ready and estimating moving costs.

Determine Your Reasons for Moving

Moving is a stressful experience at any age. Downsizing for retirement carries unique challenges.

Before you get started, determine why you’re moving.

In a 2018 study by Merrill Lynch, the number one reason given by respondents for moving in retirement was to be closer to family. The desire to reduce expenses came in a close second.

Not everyone makes the conscious decision to downsize. Sometimes a move is immediate and necessary because of rapidly declining health, the loss of a spouse or an unexpected financial crisis.

Understand your own motivation for moving. Weigh the pros and cons so that you feel comfortable with the decision.

- Where do you want to live?

- Do you want to live in the same area or a different state?

- What style home will be practical to navigate?

- How much space do you need to be comfortable?

- What sacrifices are you willing to make?

- How much time and money can you commit to the moving process?

It’s also important to communicate early and often with your family.

If you’re married, discuss any concerns your spouse may have about the process.

Make sure your kids know what’s going on, too. Let them come over and help you sort through items, especially if they grew up in the house. This can prevent conflict and resentment down the road.

Financial Aspects of Downsizing

Saving money is one of the primary reasons people downsize in retirement. Cheaper housing is an easy way to boost your budget and increase your retirement savings.

- Increased Cash Flow

- Selling your home will likely result in a windfall of cash. This can boost your savings and grow your retirement nest egg.

- Cheaper Mortgage

- If your current home isn’t paid off, a new home with a lower monthly mortgage payment can give your budget room to breathe. The money you save each month can pay for a yearly vacation or finance a grandchild’s future education.

- Less Cleaning and Maintenance

- Americans aged 55 and older spend roughly $90 billion on home renovations each year — 47 percent of the national total. A newer home will likely need fewer repairs and have lower upkeep costs than an older home. And you probably won’t spend as much money hiring help to take care of the property.

- Lower Utility Bills

- Smaller spaces and fewer rooms mean lower utility costs. If you’re moving to a home with new windows or energy efficient appliances, you may save even more.

But before you make a move, get a handle on your finances. Hidden costs and poor planning can eat up potential savings if you’re not careful.

“Selling a home isn’t cheap,” Alan Caldwell, a financial advisor based in Nashville, told RetireGuide.com. “And you almost always spend more money when you move than you planned to.”

That’s why Caldwell, founder of On Track to Retire LLC, says it’s critical to get estimates from moving companies and set a budget in advance.

“During major life events like a move, we tend to think, ‘Well, I’m in a special time right now. It’s OK to spend money because I can control it later,’” Caldwell said. “But you need to be careful and track your spending as you go.”

- Homeowners Association Fees

- You’ll owe monthly fees if you move to a neighborhood, townhome or community with a homeowners association, or HOA. HOA fees vary widely, but some sources estimate costs between $100 and $700 per month. Fees are based on the services the HOA provides, such as lawn care. The more services and amenities, the higher the HOA fees.

- Getting Your House Market-Ready

- Staging is the process of preparing your home for sale in the real estate market. It can mean many things, from painting the walls and installing new flooring to landscaping improvements and replacing bathroom faucets. It’s not cheap, but it may be necessary if you don’t want your home to sit on the market forever. Add critical home repairs to your to-do list, too.

- Homeowners Insurance and Property Tax

- Just because you move to a smaller home doesn’t mean you’ll save money on homeowners insurance. Location also matters. External factors, including crime rates and proximity to natural hazards, can increase insurance premiums. Compare rates on the same coverage with different insurance companies to get the best deal. Be aware of changes to your property tax bill, too.

- Real Estate Agent Fees

- The standard commission for a real estate agent is about 6 percent of the home sale price. If you’re selling a $250,000 home, the buying and selling agents could take a total of $15,000. “That’s a ton of money,” Caldwell said. His advice? Be aware that closing costs and agent commissions will decrease your final payout.

- Purchasing Items for Your New Home

- After you downsize, you may still need to buy things for your new home. “We tend to spend a lot of time at Home Depot and Target when we first move,” Caldwell points out. Budget for these expenses before you move and only buy what you absolutely need.

Start Downsizing

You’ve decided to move. Now it’s time to start downsizing your current possessions.

But where do you start?

It isn’t a simple process. People have created entire careers out of helping others downsize for retirement.

It may seem daunting, but don’t let the task ahead overwhelm you.

“Decisions about what to keep and what to do with the rest can create decision paralysis,” Anna Novak, downsizing expert and owner of Simply Downsized LLC, told RetireGuide.com. “It’s a huge reason people have a hard time getting started.”

Novak and other experts recommend setting goals and timelines. Hold yourself accountable.

“Generally, once people know where they are going and can envision themselves there, they can start the process of letting go and get excited about a positive change,” Novak said.

Start Small, Give Yourself Time and Make a Plan

Rushing a move can amplify an already stressful experience.

Experts, like Novak, suggest starting small. Tackle one room before starting on another. Give yourself enough time to do the job right.

You won’t finish everything in one weekend. Most experts say the downsizing process takes at least six months to a year to complete.

So it’s helpful to put a plan in place.

You can find free detailed plans for two-year, one-year and six-month timelines on HomeTransitionPros.com.

The website also offers a 15-minutes-per-day plan along with a “Planning for Downsizing” workbook with checklists and activities to help you prepare.

Be Ruthless — and Realistic

It’s easy to fall in love with objects — and often very difficult to let them go.

“Downsizing involves letting go of 70 to 80 percent of the belongings it took you 20 to 30 years to accumulate,” Novak said.

Be realistic. Take a hard look at each item in your home. Identify the things that are most useful or loved. If you haven’t used something in more than a year, donate it or throw it away.

Downsizing involves letting go of 70 to 80 percent of the belongings it took you 20 to 30 years to accumulate.

Get in a habit of finding obvious things you can get rid of, such as duplicate household items, outdated paperwork, clothing that no longer fits and old magazines.

Document Your Current Space

It may be easier to let go of your home if you can remember how it once looked.

Take pictures of rooms in your house before you start downsizing. It can be comforting to look back at your old place or see the progress you’ve made getting it organized.

Measure the furniture you want to bring and write down the dimensions to ensure it will fit in your next place.

Document furniture arrangements and the placement of family photos on the walls. You can reference these later when you unpack in your new home.

Donate and Sell Items You Don’t Need

Selling unwanted items is a good way to raise extra money for your move.

It also helps to clear space, and there’s satisfaction in knowing that your old items will benefit others.

You can use websites like Craigslist or Facebook Marketplace to list belongings. You can also try apps like LetGo, OfferUp and NextDoor.com.

Make sure to accept only cash offers to avoid scams. You may also want to meet people at a public place for these transactions.

For smaller items, or those with lesser value, consider holding a yard sale. Other options include selling to collectors, used bookstores, online auction sites or music stores.

Return items to the people they belong to. Is your 40-year-old daughter’s prom dress still hanging in the closet? Ask her if she wants it. If she doesn’t, get rid of it.

Some charities, such as the Salvation Army, can pick up items from your doorstep free of charge.

Another option is a website called Give Back Box. Just pack your unwanted items in a box, go to the website and print out a free shipping label.

The box will then be mailed to a local charity. Give Back Box will even email you a receipt for a tax deduction.

Consider Hiring an Expert

A growing industry of professionals offers services to help retirees downsize.

Senior move managers specialize in helping older adults and their families with the emotional and physical aspects of relocation or aging in place.

They even have their own trade organization — the National Association of Senior Move Managers, or NASMM. Its membership has grown from 650 in 2012 to roughly 1,100 in 2020.

Similarly, professional organizers can help you declutter your home, offer emotional support, facilitate the disposal, donation or sale of unwanted belongings and set up systems that help you stay organized.

These professionals work alongside you. They do not provide cleaning services.

Costs can vary by state and job, but rates usually range between $75 and $150 an hour.

That may seem pricey, but the time and effort you save might be worth it.

“It’s like hiring a wedding planner for a wedding,” Mary Kay Buysse, executive director of NASMM, told RetireGuide.com. “Yes, you can probably do the job yourself. But if you want it done seamlessly and want less stress in your life, then hiring a professional is a smart move.”

Buysse said these professionals often offer a menu of services that can be tailored to fit your budget.

“It isn’t an elitist thing or something that only people with lots of money can afford,” Buysse said. “Sometimes families will only hire someone for part of the process.”

Home-service provider directories like TaskRabbit and Angie’s List are good places to find local help.

You can also use the NASMM’s online directory to find a senior move manager near you.

Cope with Your Emotions

Wading through a lifetime of memories is daunting — and draining.

Downsizing can uncover a well of emotions, including sadness, anxiety, stress and grief.

If something’s been a part of your home life for 40 years, it’s not easy to say goodbye.

According to a 2018 letter from the Harvard Medical School: “Understanding the triggers for these feelings and using strategies to navigate them may not change how you feel, but it may help the downsizing process go more smoothly so you can focus on your next chapter.”

If you find yourself in emotional turmoil, talk to someone. Invite a friend or family member over to help you sort through rooms.

Loved ones can listen to you reminisce about sentimental objects while providing you with a gentle push to let go of things you no longer need.

“If something’s been a part of your home life for 40 years, it’s not easy to say goodbye,” Buysse said. “Our items tend to become like members of the family.”

Even venting to an old friend over the phone after a stressful day of decluttering can calm your nerves and keep you focused.

If you don’t have someone to lean on, consider professional help. You may want to visit your primary care doctor or speak with a therapist.

Selling Your Current Home

Selling a home can be a time consuming, complex process.

But if you’re downsizing in retirement, it’s also important to understand taxes and how profits from your home sale can affect government benefits.

Beware of Capital Gains Tax

The Internal Revenue Service and several states levy capital gains tax on the difference between what you paid for your home — known as your cost basis — and what you sell it for.

The good news is that this probably won’t affect you. You can usually exclude up to $250,000 of capital gains on real estate if you’re single and $500,000 if you’re married and filing jointly.

So, if you first bought your house in the 1980s for $200,000 and you sell it today for $400,000, you won’t owe capital gains tax.

A few things may disqualify you from claiming that $250,000 or $500,000 exclusion. For example, the house must be your primary residence and you must have lived in it for at least two out of the last five years.

If capital gains tax is unavoidable, you may still qualify for a zero percent tax rate in 2021 if your income is less than $40,400 for a single person or $80,800 for a married couple filing jointly.

Otherwise, you may pay either a 15 percent or 20 percent tax rate. It depends on your filing status and income.

The Impact of Selling Your Home on Government Benefits

Owning a home won’t prevent you from collecting certain government assistance benefits, such as Medicaid or Social Security Income (SSI) disability.

But selling your home is a different story. This boosts your income, and the sudden cash may disqualify you from Medicaid and disability benefits.

For example, you must have less than $2,000 in countable assets to keep your Medicaid or disability coverage. Selling your home will net you more than $2,000.

To keep Medicaid, sale proceeds must be legally spent down or protected by the end of the following month.

With SSI, you have three months to buy a new home after selling your old one. If you do so and have less than $2,000 in your bank account, you will keep your SSI benefits.

If you don’t, you will lose your benefits for each month your assets exceed the permitted limit.

If it takes you more than 12 months to spend down money from your home sale, you may have to start the entire disability application process from the beginning.

And keep in mind that you’re not allowed to transfer money to a family member.

There are several legal ways to work around government benefit asset limits after selling a home. Consult a trusted legal professional for more information.

Moving Costs and Other Expenses

According to an October 2020 poll conducted for North American Van Lines, 45 percent of people who recently moved said the experience was the most stressful event in their lives.

One way to cut down on stress is by developing a solid moving plan that fits your budget.

- Cost to Rent a Moving Truck

- Renting a moving truck, such as a U-Haul, can cost between $90 for a small truck and a local move to $2,000 for a large truck and a long-distance move. The cost depends on how far you’re traveling, how much truck space you need, how long you keep the truck and gas.

- Cost to Hire a Moving Company

- Hiring a moving company to transport your belongings can cost between $80 to $100 per hour for short distances and $2,000 to $5,000 per load for long distances. Hiring a mover typically costs $25 to $50 per hour for each worker. The overall cost depends on the size of your home and the distance you’re traveling. Moving heavy objects or navigating staircases can cost extra.

- Full-Service Movers Cost

- According to HomeAdvisor.com, hiring a full-service moving company usually costs at least $2,300, but it depends on distance and the square footage of your current home. You may be able to spend as little as $900 for a local move, or as much as $10,000 for a cross-country move. Make sure to get visual estimates and total cost estimates. Understand the difference between binding and nonbinding estimates to avoid expensive surprises.

- Cost to Rent a Moving Container

- Renting a moving container can cost an average of $3,000 a month, according to Move.org. Moving containers cost an average of $2.50 per mile to transport. But the total price may be as low as $250 for a small container and a local move to $4,000 for a large container and a cross-country move. You can request a moving container from companies such as PODS and U-Pack. They drop off the container, and you load your belongings into it on your own time. The container company will then pick it up and drop it off at your new location. If you’re downsizing, you may also consider renting a storage unit.

This can allow you to keep items that are too difficult to part with.

- Memorabilia

- Boxes of old family photos and letters

- Oversized items

- Antique furniture or family heirlooms

According to Zillow, the average national cost of a storage unit ranges from about $50 per month for a small unit to $300 or $400 for larger units.

If your main reason for downsizing is to cut costs, you need to be mindful of this added reoccurring expense.

Expert Tips on Downsizing for Retirement

Vickie Dellaquila is a Pittsburg-based professional organizer with nearly two decades of experience. She is the owner and founder of Organization Rules, Inc. and has given presentations at several national conferences and conventions. She is also the author of the book, “Don't Toss My Memories in the Trash: A Step-by-Step Guide to Helping Seniors Downsize, Organize, and Move."

Downsizing is extremely emotional and physical work. You’re going through a lifetime of memories. It’s exhausting. Let yourself experience those emotions, whether you want to cry, laugh or be angry. Giving yourself enough time will also help you process those feelings.

You’ve spent a lifetime accumulating stuff. It’s going to take time to go through it all. I always tell people to start now. You may be able to do it in a month, but I tell people to give themselves at least six months. A year or two years is even better.

When you start the process, put a downsizing session on your calendar, the way you would a doctor’s appointment. So, from 9 a.m. to noon on Saturday, I’m going to work on the kitchen. Stick to it. Try to avoid procrastination.

Start with areas you don’t really live in, like spare bedrooms, the basement or the attic. Many times, these spaces have lots of things you aren’t using, or that you forgot you had. The garage is another good place to start because this is usually an exit route. It can be physically easier to move things out of this space.

If you know where you’re moving, getting a floor plan will certainly help you make decisions. It can also help you figure out where everything will go and how much space you really have.

Finding a New Home

When you’re looking for a new residence, take time to consider your needs. Make sure the space fits your lifestyle, budget and level of independence.

You may decide to purchase a new home, move in with family, transition to an assisted living facility or rent a townhouse or condo.

A great freedom in retirement is the chance to live where you choose. You may have bought your former home because it was in a good school district or close to work. Your life is different now, so explore your options.

Look for housing that puts you closer to things you care about, like your family, an airport, public transportation, a grocery store or your favorite nature preserve.

It’s also critical to be realistic about what your physical limitations will be in the future. For example, a one-floor house will be easier to navigate than a two-story house.

Downsizing Without Moving

Moving to a new location isn’t right for everyone. Some people want to stay in their home but still want greater financial independence.

There are a few options if you’re interested in downsizing without moving.

- Rent Out a Room

- Renting a room in your home, or even converting the property to dual occupancy can increase your monthly income. But be careful and selective with potential renters. Speak with a legal advisor who can help you draft a simple lease agreement for your new tenant. Research your rights as a landlord. Lay out clear ground rules and restrictions before you let someone move in.

- Consider a Reverse Mortgage

- Some seniors opt for a reverse mortgage to boost income and age in place. A reverse mortgage allows people aged 62 or older to stay in their homes while drawing on the equity they've already built. But there’s risk involved and a long-term financial impact, so make sure to get independent financial advice first.

- Pretend You’re Moving and Declutter Accordingly

- It’s always a good idea to declutter and organize your space — even if you’re not going anywhere. Selling unwanted or unused items can also raise money you can reinvest in home repairs or save for the future.

Downsizing for retirement means something different to everyone. It’s often stressful and requires careful planning and financial considerations.

But it can also be a rejuvenating experience. Focus on the positive aspects of the transition, and work toward making your new space feel like home.

Additional Resources

- Donation Town

- Don’t want the hassle of transporting big objects to your local thrift store? There are dozens of charities that can send a truck to your home and pick up your belongings for free. Enter your zip code into the Donation Town pickup service directory to find nonprofit organizations that offer this service.

- National Association of Productivity & Organizing Professionals

- If you want to hire a professional organizer to help you declutter your home, the National Association of Productivity & Organizing Professionals can help. Enter your zip code into the organization’s directory, and you’ll find numerous professional organizers and productivity consultants near you.

- National Estate Sales Association

- This website offers multiple guides about estate sales and how